The holistic solution for individual and group; life and health.

Life Insurance System

With Life Insurance System (LIS), there is no longer any need to bolt together separate components, for life and health, for individual and group, for traditional, universal life and unit-linked. LIS accommodates all of these seamlessly. And being a client-based system, LIS even allows you to view individual clients across your individual and group portfolios.

Features

LIS has modules to address all your needs:

- Product definition

- New business and underwriting

- Customer service and policy administration

- Claims

- Reporting and statistics

- And APIs to allow smooth interfacing with other systems – whether Sinosoft ones or from third-parties.

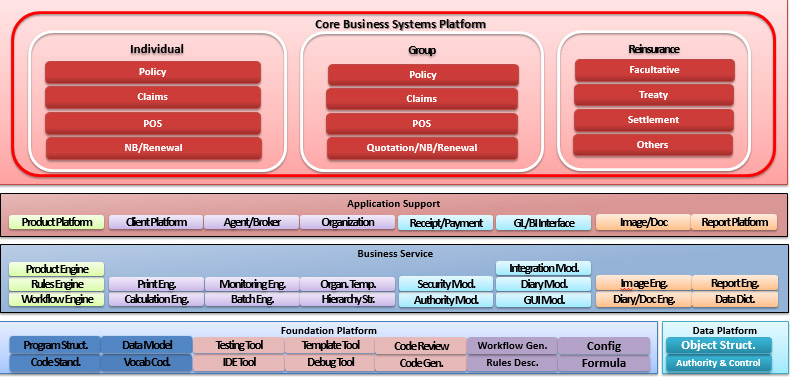

The architecture of LIS can be viewed as having four layers:

The basic platform comprises the system environment, including databases, programming framework, a number of work engines, middleware, security components and development tools. The core software layer contains meta-data management, standard specifications and the core business and financial management systems.

Design Principles

A key design principle underlying LIS (and indeed all our systems) has been to modularize as much as possible. This ensures that any future enhancements are ring-fenced and much easier to implement. This has also allowed the system to offer the very greatest level of functionality. In addition to that, LIS has been built with performance and security firmly in mind: two areas where the system excels.

In everything we’ve done, we have sought to ensure that LIS remains a highly user-friendly system, utilizing quality UI and UX.

All of these together ensure that Life Insurance System is wholly scalable. (Indeed, there are users of LIS with over 10 million customers.)